How GSTR-2B Helps in Claiming ITC Correctly, Get Practical GST Course in Delhi, 110080, by SLA Consultants India, New Delhi,

1 day ago Del Monte, Philippines Ad Views:22 Ad ID: 346Additional Details

- Ad ID346

- Posted On1 day ago

- Ad Views22

- Salary period *Monthly

- Position type *Full-time

Description

GSTR-2B is an auto-generated Input Tax Credit (ITC) statement that helps businesses claim ITC accurately and avoid mismatches. It is generated on the 14th of every month and reflects ITC based on GSTR-1, GSTR-5, and GSTR-6 filed by suppliers.

Why is GSTR-2B Important for ITC?

Ensures ITC Accuracy: Matches supplier invoices with your purchases. GST Course in Delhi

Prevents ITC Rejections: Avoids claiming ITC for unreported or ineligible invoices.

Reduces Errors & Notices: Helps reconcile ITC in GSTR-3B and prevents mismatches.

How to Use GSTR-2B for ITC Claim

Step 1: Download GSTR-2B

- Login to GST Portal.

- Go to Returns Dashboard > GSTR-2B.

- Select the relevant month and download the statement.

Step 2: Verify Eligible ITC

- Match supplier invoices with auto-populated ITC in GSTR-2B.

- ITC is categorized as:

- Eligible ITC: Can be claimed in GSTR-3B.

- Ineligible ITC: Blocked credits (e.g., motor vehicles, personal expenses).

Step 3: Reconcile GSTR-2B with Purchase Register

- Cross-check invoice details (GSTIN, invoice number, tax amount) with your purchase records.

- If an invoice is missing, follow up with the supplier to correct GSTR-1.

Step 4: Claim ITC in GSTR-3B

- Use Table 4(A) in GSTR-3B to claim eligible ITC.

- Ensure ITC matches GSTR-2B to avoid rejection.

- Report reversals (if needed) under Table 4(B)(2).

Best Practices for ITC Claims Using GSTR-2B

✔ Always reconcile GSTR-2B before filing GSTR-3B.

✔ Follow up with suppliers for missing invoices.

✔ Avoid claiming ITC on blocked credits to prevent penalties.

✔ Maintain records for future audits and compliance.

Master ITC & GST Compliance with SLA Consultants India

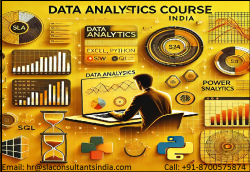

Join SLA Consultants India's Practical GST Certification Course in Delhi (110080) to learn:

How to use GSTR-2B for accurate ITC claims.

ITC reconciliation techniques with GSTR-3B.

Real-world GST case studies and hands-on training.

Enroll today and claim ITC with confidence!

SLA Consultant How GSTR-2B Helps in Claiming ITC Correctly, Get Practical GST Course in Delhi, 110080, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar,New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website : https://www.slaconsultantsindia.com/